In theory, a black swan event is one that is not normally expected and has potentially severe consequences. Investopedia defines them as ‘events that are characterized by their extreme rarity, their severe impact, and the widespread insistence they were obvious in hindsight’.

The global outbreak of Covid-19, which originated in Wuhan, China in December 2019, can be rightfully called a black swan event. It has collectively pushed the global economy into a recession, called the ‘Great Lockdown’, which is being assumed to be worse than the Great Depression of the 1920s. There will be a huge impact of COVID 19 on the Indian economy.

The Indian economy was already slowing down and was in a parlous state before Covid-19 struck. The exact impact of the COVID 19 on the economy can only be determined by factors such as

- How long the lockdown lasts, and the manner in which it will be lifted?

- How efficiently the health crisis is dealt with?

- Change in Export/Import figures etc

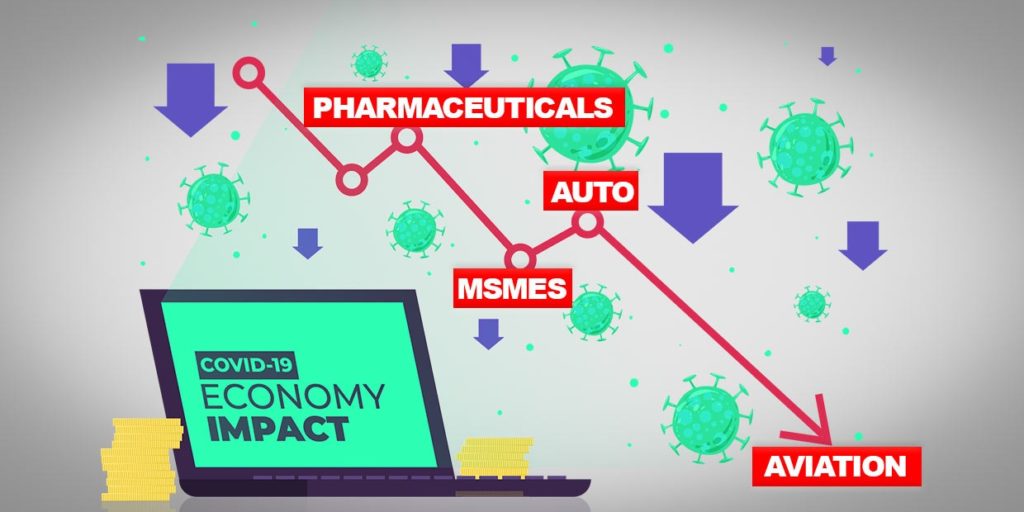

While the lockdown is currently ongoing, this report attempts to outline and project the impact of the crisis on four sectors of the economy MSMEs, Aviation, Pharmaceuticals, and Automotive, while suggesting a few recommendations to deal with the same.

COVID-19 impact on MSMEs – Micro Small and Medium Enterprise

MSME sector is one of the strongest drivers which will help India to overcome the economic impact of COVID 19, with a contribution of 30-35% of the GDP while providing employment to 114 million people. According to the latest annual report by the Government, there are 63 million MSME units in India, with the units being highly heterogeneous in terms of size, and the products and services they provide.

Perhaps it is this heterogeneity that exposes the sector to various risks during the ongoing COVID-19 crisis, as the Government’s relief package of ₹1.7 lakh crores fails to address the specific issues being faced by the various units of the sector.

Despite the global slowdown in demand, the shutdown in production due to the ongoing lockdown will have a significant impact. A recent survey by FICCI, with a sample size of 317 units, reported that 73% of the businesses have experienced a significant fall in the number of orders, with 50% of them reporting an increase in inventory levels by 15%.

Due to a fall in orders majorly, the units may find themselves short on cash and liquidity, which will severely impact the working capital needs during the lockdown. The liquidity crunch may cause the firms to reconsider their plans for expansion, thereby affecting their future efficiency. However, the immediate respite will come from not paying the wages to those employed under them. This will cause social unrest, something which we are already witnessing.

There will be a considerable drop in global demand, mainly because of Europe and the U.S.A. being majorly affected by the pandemic. This will have a direct impact on MSMEs engaged in consumer goods, apparel, automotive segments, etc. Some MSMEs engaged in imports-dependent sectors like electronics, pharmaceuticals, etc. may also face a supply chain disruption due to the bottlenecks arising because of the same reason.

A wage support or subsidy package is another possible measure which will allow these enterprises to retain their employees during this slowdown. These methods will lower the brunt borne by these enterprises due to the lack of working capital. However, the major challenge lies in coming up with an appropriate policy framework that will work out the

intricacies involved in providing wage support.

COVID-19 impact on the aviation sector

The Aviation sector is supported by one of the fastest-growing domestic air markets in the world, a claim which can be supported when we compare the Revenue Passenger Kilometre (RPK) growth of India, which stood at 18.6% in 2018, to the global RPK growth, which was 6.5% (roughly one-third of the Indian figure). It employs about 8 million people and contributed $72 billion to the GDP in FY19.

According to ‘Invest India’, the Indian aviation market is expected to become the 3 rd largest by 2024. However, the coronavirus outbreak has dampened the positive outlook of the people regarding the sector.

Due to the global nature of this pandemic, and the strict rules imposed by the governments from all over the world in order to immobilise people to stop the further spread of the virus, the aviation sector will not only suffer during this period but also after the restrictions are eased due to the panic that will continue to influence people. People will avoid travelling unless it is necessary, and no amount of deep discounting and price variations is expected to overcome this behavioural change.

The immediate and direct impact of COVID 19 on the Economy will lead the value chain comprising the industry, from airlines, airports, cargo handlers, to fuel suppliers, service providers, and the hospitality industry. With international and domestic travel closed, the demand for fuel will substantially decrease. Even after traveling is allowed, the demand is not expected to bounce back due to weak consumer sentiments.

COVID-19 impact on the Pharmaceuticals Industry

India supplies more than a quarter of the world’s generic drugs and 50% of the global demand for vaccines, rightfully earning its title as the ‘Pharmacy of the World’. According to IBEF, the pharma industry is expected to grow to a whopping $100 billion by 2025. Currently, the market size stands at $55 billion. Medical spending in India is projected to grow by 9-12% over the next 5 years, which will make India one of the top 10 countries in terms of medical spending.

The current impact Covid-19 on the various economic sector remains merely short term and is not expected to have a substantial negative effect. In fact, it may even provide a boost to the sector by allowing it to become India’s comparative advantage, given how demand for public goods and services is highly likely to go up in the future.

However, this will prove to be a task as India is still heavily reliant on imports from China to produce its generic drugs. When the outbreak was at its peak in China, the stalling of all the imports proved to be problematic to produce pharmaceutical drugs.

The pharma companies managed to survive this blow by using their inventories, which lasted them a good 3-4 months. According to Bloomberg, 70% of India’s imports of APIs (Active Pharmaceutical Ingredients) comes from China, which totals $2.4 billion out of its $3.56 billion import bill of the same. The supply chain disruption faced by the sector has led to high price variations, with an increase of 40-50% being reported in specific cases.

This, along with the shutdown of local factories due to the lockdown, has impacted access to medicines in certain areas. However, with the easing of regulations in China and production resuming, the supply disruption of raw materials should ease out.

The pandemic has made people anxious, which has led to the stocking up on essential medicines and various drugs that they believe to be potential cures. The sudden spike in sales has provided some relief to the companies, as the cash flow constraint can be managed by unloading their inventory in the supply chain to meet the current demand.

COVID-19 impact on the Automotive industry

With almost no sales due to the weakening of demand and the persistent cash flow constraints, the companies are being forced to take extreme measures to continue their operations. They are redirecting their funds from R&D towards core operations, thereby undoing 2-4 quarters worth of progress made on alternative fuel models and mechanisms, something which would’ve allowed them to revive the demand for their products in the market in the future. The companies are left bargaining between short-term survival and long-term growth.

The lack of working capital has left companies to consider suspending further manufacturing of products, as they would only add to the inventory and further block the working capital if they remain unsold. The latest figures have projected this situation to be a highly likely one. Units along the value chain are focusing on staying solvent during these trying times.

India majorly imports automotive parts from China, and its reliance on them is not expected to fall anytime soon as the government pushes for electric vehicles. China has global leadership in manufacturing components for EVs, which impose a threat to the local manufacturers.

The disruption in the supply of raw materials by China due to Covid-19 will only affect the imports for a while. This combined with the fact that the global slowdown has affected sentiments in key markets (which, in turn, will affect the exports), is set to worsen the ever-increasing trade deficit.

Group Discussion Topics for 2021